Sachin Bansal cashed out of Flipkart when the Americans moved in five years ago. But his cofounder Binny Bansal had held on to his stake. Now, 16 years after starting the ecommerce company, Binny, too, has sold all his Flipkart shares to the US retail giant Walmart. This and more in today's ETtech Top 5.

Also in this letter: ■ NBFC Clix Capital secures Rs 1,200 crore debt

■ First half of 2023 sees 17,000 startup job cuts

■ Foxconn to invest Rs 1,600 crore in Tamil Nadu

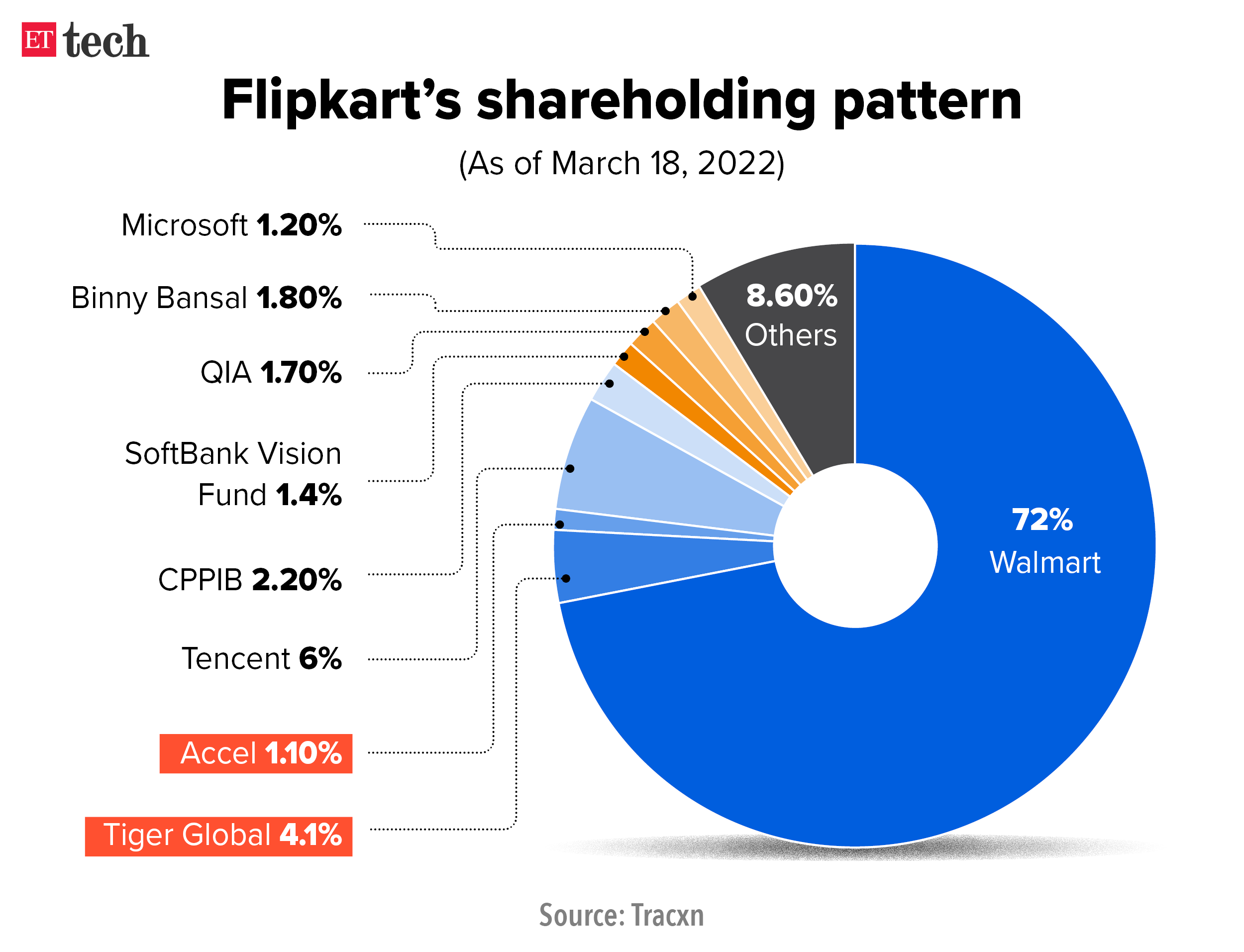

Binny Bansal sells Flipkart stake to Walmart; US retailer to hold almost 80%

Binny Bansal has

sold his residual stake in Flipkart to Walmart, which had acquired the etailer in 2018 for $16 billion. This ends Bansal's holding in the ecommerce platform, one of India's most successful internet startups. Cofounder Sachin Bansal had completely divested his 5% holding in Flipkart to Walmart for about $1 billion at the time of the acquisition.

Following Tiger: Bansal's exit from the company follows the departure of Tiger Global from the captable. ET reported on Monday that Tiger and Accel, both early investors,

sold a cumulative 5% stake in the company to Walmart, making a profitable exit. Tiger Global had pumped $1.2 billion into Flipkart, starting with a $9 million cheque in 2009, and made a total of $3.5 billion on its exit. The ecommerce company was valued at $35 billion in the latest transaction.

Gradual exit: Tiger first sold a chunk of its shares in Flipkart to SoftBank Vision Fund in 2017, racking up about $1 billion. This was followed by a nearly $2.5-billion sale to Walmart in 2018.

Bansal's holding: Binny Bansal, who departed from Flipkart in November 2018, retained over 2% in the company after a funding round

that raised $3.6 billion two years ago. During the 2021 transaction,

Bansal partially sold his stake for approximately $200-250 million.

Also Read | Flipkart founder Binny Bansal eyes stake in Prime Volleyball Bengaluru team | Liked reading? Share this story |

|

Dealshare CEO Vineet Rao steps down; will work with board to identify successor

Social commerce grocery startup Dealshare's chief executive

Vineet Rao has stepped down, the company said on Monday.

The reason: According to the company, Rao's departure is part of a "pivot to a hybrid online and offline model". He will work with the company's board to identify his replacement and "will also continue to work with and advise the board in respect to the new leadership," the company said in a statement.

Rao founded the startup along with Sourjyendu Medda, Sankar Bora and Rajat Shikhar, all of whom still remain at the firm in different capacities.

Founders' stake: Rao holds about 11.7% in the firm while Medda has 7.1%, and Bora owns about 3.2% in Dealshare as of March 2022, according to shareholding data from Tracxn.

External hires: Dealshare

hired former Big Bazaar chief executive Kamaldeep Singh as president of its retail business in December. Later, it also appointed Rajesh Purohit, a senior executive from SPAR Hypermarkets India, as its SVP in March.

Layoffs and pause in ops: The Bengaluru-based firm, which extended its presence to approximately 150 cities and towns last year, has temporarily halted operations in around one-fifth of those locations. The company, backed by Tiger Global, Matrix Partners and Alpha Wave Global,

had laid off around 100 employees, or over 6% of its then 1,500-strong workforce, in January.

| Liked reading? Share this story |

|

Subscribe to our daily newsletter ETtech Morning Dispatch for the latest insights from the world of technology and startups. |

| Subscribe |

NBFC Clix Capital secures Rs 1,200 crore debt

Gurugram-based Clix Capital is flaunting its newfound green credentials. The non-banking financier has

secured Rs 1,200 crore in debt funding in the current quarter, of which Rs 164 crore came from the Global Climate Partnership Fund.

What it does: Clix extends unsecured retail loans to small enterprises. It also offers consumer loans and secured loans for school and healthcare equipment financing. Only a small portion of its loan book is exposed to the corporate sector.

Sustainability push: Clix aims to fund sustainable business projects with the infusion of green funds from the Luxembourg-based Global Climate Partnership Fund. The company is looking to fund projects that can help fight climate change.

Quote, unquote: "As a responsible lender, we are committed to supporting India's green journey via credit support and assisting businesses with CO2 reporting, green lending development, and environmental and social risk management initiatives," said Rakesh Kaul, chief executive officer, Clix Capital.

| Liked reading? Share this story |

|

Startups cut over 17,000 jobs in the first half of 2023

With no thaw in the funding winter, the

Indian startup ecosystem has undertaken mass layoffs, leaving thousands without jobs.

Data says: In the first half of 2023 alone, approximately 70 startups collectively laid off more than 17,000 employees, according to data from CIEL HR, a recruitment and staffing firm.

The lack of new investments flowing into the industry has become the biggest challenge for these startups, resulting in cost-cutting measures and cash conservation, said Aditya Mishra, MD and CEO, CIEL HR.

Sectors impacted: Ecommerce (including segments such as grocery, baby care and personal care), fintech, edtech, logisticstech and healthtech are among the sectors majorly impacted by layoffs.

Unicorns no different: Apart from smaller firms, even well-known unicorns such as

Meesho,

Unacademy,

Swiggy and

ShareChat have had to cut jobs. Edtech startup Byju's, which is facing multiple crises,

has fired 500-1,000 employees this year.

| Liked reading? Share this story |

|

Foxconn arm to invest Rs 1,600 crore in Tamil Nadu

Hon Hai Precision Industries, also known as Foxconn,

will invest Rs 1,600 crore in Tamil Nadu via its arm Foxconn Industrial Internet (FII) to build an electronic components manufacturing plant.

6,000 jobs: The Taiwanese chipmaker plans to build a facility to make electronic components in Kancheepuram district. The plant will provide jobs to over 6,000 people, the government said. Foxconn already operates an iPhone assembly facility in Chennai, where it employs about 35,000 people.

Foxconn's India push: The semiconductor company has already made investments in India with its upcoming

iPhone facility near Bengaluru, and talks for another investment by FII in the

Tumakuru district are underway. The company has also made investment promises in Telangana with its

Rs 4,000 crore electronics manufacturing facility in Hyderabad.

Also read | EV parts to iPhones, Foxconn making India second home Today's ETtech Top 5 newsletter was curated by Siddharth Sharma in Bengaluru and Megha Mishra in Mumbai.

hate it

hate it  meh

meh  love it

love it

Comments

Post a Comment