There are many types of online real money games, and the government has not banned all of them, only those that involve wagering, Rajeev Chandrasekhar, minister of state for electronics and IT (MeitY), told ET. This and more in today's ETtech Top 5.

Also in this letter:

■ Crypto transfers to face scrutiny

■ New ONDC incentive structure from June 1

■ Why SoftBank eased up on India investments

Government to certify 'permissible' online games for now: MoS IT

The IT ministry has decided to certify which

online games are permissible until the gaming industry forms a self-regulatory organisation (SRO), Rajeev Chandrasekhar, minister of state for electronics and IT (MeitY), told ET. A notification to this effect is expected to be sent soon to platforms such as Google and Apple.

ET impact: The minister's statement comes after ET reported on Tuesday that tech giant Apple — citing lack of regulatory clarity —

has not fully complied with MeitY's February order banning 138 betting games, and that many of these apps are still available on its app store.

Tell me more: "What the article has alerted us to is that we can't keep things hanging, waiting for an SRO," said Chandrasekhar. "In the interim, the government can certify what is a permissible game, what is wagering, what is not wagering."

He added that the government will write to internet intermediaries asking them to approach MeitY in case there is confusion on takedown orders about real money gaming, gambling and betting apps.

Problems with versions: On Tuesday, Apple told ET it has taken down the main app of Betway, one of the betting platforms banned by MeitY, from the India storefront and asked MeitY for the identification numbers of the other apps. However, several other versions of Betway are available on the Apple App Store.

"I suspect, there are say seven different versions of a game and the company is not able to figure out which one they are supposed to take down, so we are saying, we will certify what is permissible, what is not in the interim," said Chandrasekhar.

SRO yet to be formed: According to the

final rules for online gaming, the Centre will notify SROs, three to begin with, comprising different experts. But, ET reported on May 7 that online gaming companies

are not in favour of an SRO backed by the Internet and Mobile Association of India, as they did not see the interests of the industry grouping aligning with their own.

| Liked reading? Share this story |

|

Crypto transfers to private wallets to face ID checks

Money launderers freely moving cryptocurrencies in private wallets might have to think twice as Indian crypto exchanges are working on

mandatory identification of the persons behind crypto wallets.

Driving the news: "What kind of ID, how would these be provided, and what could exchanges do to check the authenticity of the ID are under discussion," a senior official at a large platform told ET.

Existing loopholes: In crypto trades, the identities of buyers and sellers are known if they're clients of local exchanges. However, there is no procedure to ascertain the identity of a private wallet owner, or a regulation that restrains a person from shifting cryptos from the wallet of an exchange in India to the private wallet of an individual, who could be a foreign national.

Shining a light: Under the new mechanism, the person who sends cryptos would in all likelihood either know the details of the recipient or will be in a position to obtain those details. The proposed rule, even if a little onerous, could thus lend a degree of immunity to platforms.

| Liked reading? Share this story |

|

Subscribe to our daily newsletter ETtech Morning Dispatch for the latest insights from the world of technology and startups. |

| Subscribe |

ONDC to launch revised incentive structure from June 1

The government-backed Open Network for Digital Commerce (ONDC) will bring in a new incentive structure from June 1, effectively changing how discounts are offered to customers ordering on the network. The move is a part of ONDC's plan to eventually withdraw discounts and incentives.

The details: Under the new scheme, the maximum discount that can be offered per order has been limited to Rs 100, from Rs 125 earlier. Further, the discount will only be offered to users whose order value is more than Rs 200 in the case of food orders, and Rs 300 in the case of other products. The minimum order value to avail discounts includes shipping fees, according to a notification issued to network partners by ONDC.

Also read | Explained: ONDC vs Zomato-Swiggy and what it means for the food-delivery space Yes, but: Seller-side participants said that the cap on the first set of incentives for subsidising delivery charges, instituted earlier this month, had a negative impact on the number of orders. In May, ONDC orders had peaked at 25,000 orders a day but have since fallen to an average of 13,000 orders a day, the person said, adding that most of these orders were on account of food and groceries. This does not include the mobility numbers from Namma Yatri, an auto-rickshaw ride-hailing platform.

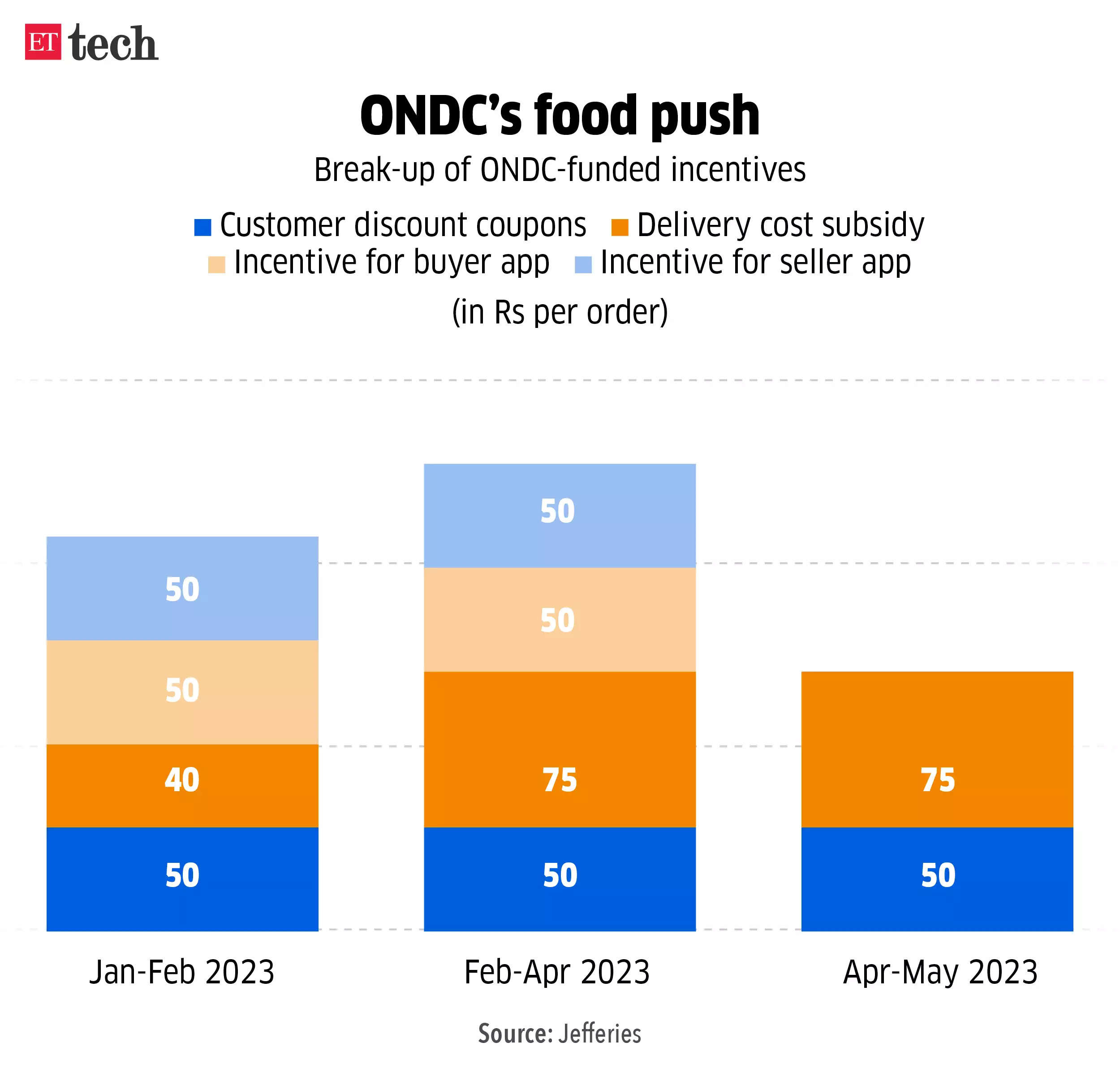

Discounting play: Brokerages and research firms have questioned the sustainability of ONDC's model, which is currently driven by discounts and subsidies. Earlier this month,

brokerage firm Jefferies noted that "the popular narrative currently seems to be that lower prices imply Zomato/Swiggy are over-charging" but the reality is, it noted, that despite significant scale, a steady rise in take rates and an acute cost focus, both were barely making any profits.

| Liked reading? Share this story |

|

Late-stage drought led to SoftBank going slow in India: BofA Securities

Japanese conglomerate SoftBank has stayed away from making any new investments in India over the past year

due to the lack of late-stage opportunities, according to a BofA (Bank of America) Securities report.

Report findings: The report said that since the formation of its local team in the country post 2019, SoftBank has focused on India-specific models instead of global replicas, with valuation benchmarks shifting down from $5 billion to around $2 billion, and average cheque sizes shrinking to $100-150 million from $1 billion previously.

Investment strategy: In keeping with this shift, SoftBank Vision Fund II's India investment strategy focuses on smaller-scale, early-stage, regional and sectoral diversification unlike SVF I, the report said.

Quote, unquote: "The firm seeks to diversify risk in the fund portfolio itself by managing multiple funds with the characteristics of both SVF I with its mainly concentrated investments and SVF II with its mainly diversified investments," the report noted.

Tweet of the day

| Liked reading? Share this story |

|

RBI to map out bigger global play for Indian payments system

Internationalisation of the

Indian payments system will become a priority for the Reserve Bank of India (RBI), along with its inclusion agenda. The RBI plans to widen the scope of Unified Payments Interface (UPI) to accelerate digitisation, it said in its annual report.

Tell me more: The RBI's Payments Vision Document 2025 has already outlined expanding the global outreach of UPI and RuPay cards as one of the key objectives under the internationalisation pillar.

RBI's take: "Efforts are being undertaken for inter-linking UPI with Fast Payment Systems (FPS) of other countries to enable both foreign inward and outward remittances using the UPI platform," it said.

Progress so far: The RBI and the Monetary Authority of Singapore (MAS) operationalised linkage of UPI and Singapore's real-time payment system PayNow on February 21, 2023. Acceptance of UPI through QR codes has been enabled in Bhutan, Singapore, and the UAE.

Today's ETtech Top 5 newsletter was curated by Gaurab Dasgupta in New Delhi. Graphics and illustrations by Rahul Awasthi.

hate it

hate it  meh

meh  love it

love it

Comments

Post a Comment