Finance Minister Nirmala Sitharaman tabled the Economic Survey 2022-23 in Parliament on Tuesday. While the document largely gave an insight into the macroeconomic health of the nation, there were a slew of measures the Survey put forth to iron out the challenges faced by the country's burgeoning startup and ecommerce sector. It also suggested a path of caution for the highly volatile and unregulated crypto space.

Also in this letter: ■ Eco Survey: Recommendations for e-commerce, cryptocurrency

■ Eco Survey: India's EV market to hit 1 crore units in annual sales by 2030

■ Stripe eyes $3 billion funding at slashed valuation

Economic Survey calls for simpler tax rules to bring startups back

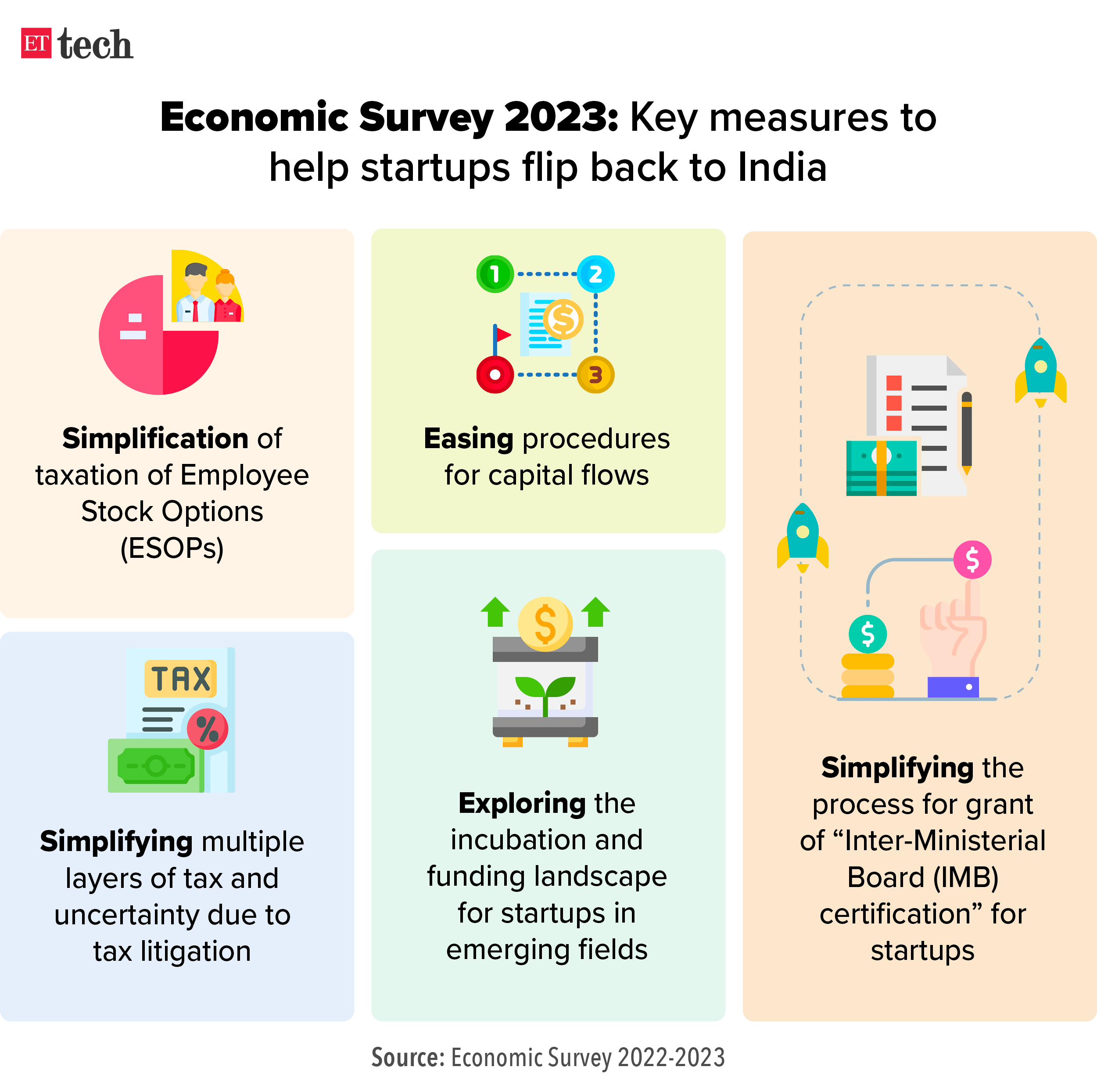

Pointing out that startups operating in India are exploring "reverse flipping", or shifting domicile from countries like Singapore back to India, the Economic Survey 2022-23 has suggested measures to accelerate the process.

This comes after fintech major

PhonePe highlighted the challenges it faced in completing its shift back to India and that its investors had to pay Rs 8,000 crore in taxes to do so.

Survey suggestions: Simplification of taxation of Employee Stock Options (Esops), and multiple layers of tax and uncertainty caused by tax litigations. It has also recommended easing procedures for capital flows with lesser restrictions on the inflow and outflow of capital.

Jargon buster: 'Flipping' is the process of transferring the entire ownership of an Indian company to an overseas one, accompanied by a transfer of all IP (intellectual property) and all data hitherto owned by the Indian company.

Quote unquote: "It effectively transforms an Indian company into a 100% subsidiary of a foreign entity, with the founders and investors retaining the same ownership via the foreign entity, having swapped all shares," the survey document said, adding that of late, with relatively easy access to capital, changes in rules regarding round-tripping, and the growing maturity of India's capital markets companies are exploring reverse flipping, or moving back their domicile back to India.

Catch up quick: Recently digital payments major PhonePe moved its domicile from Singapore to India, and its

CEO Sameer Nigam flagged the challenges faced by Indian startups in moving their base back to India such as listed capital gains tax paid by shareholders and investors, resetting of the vesting period for employee stock ownership plans (Esops), and the inability to offset losses.

Also read |

ETtech Explainer: why PhonePe investors paid Rs 8,000 crore to shift base to India? | Liked reading? Share this story |

|

Economic Survey 2023: what's in it for ecommerce, cryptocurrency

The Survey highlighted the need for a

common approach to regulating cryptocurrencies, adding that an unregulated crypto market is challenging the financial systems around the world.

It also said that India's e-commerce market is projected to post gains and grow at 18% annually through 2025, citing Global Payments Report by Worldpay FIS.

Ecommerce push: The government's intiatives to boost the digital economy, growing internet penetration, rise in smartphone adoption, innovation in mobile technologies, and increased adoption of digital payments has accelerated the adoption and growth of e-commerce. As per a report 'How India Shops Online 2022' by Bain & Company, emerging categories – fashion, grocery, general merchandise – would shore up e-commerce growth in India and would capture nearly two-thirds of the Indian e-commerce market by 2027.

Crypto recommendations: The recent collapse of crypto exchange FTX and the ensuing sell-off in the crypto markets have exposed the vulnerabilities in a largely unregulated sector. The Survey suggested global standards on cryptocurrencies which need to be comprehensive and consistent; regulatory responses must be based on standard taxonomies and reliable data to address contagion effects. These must be flexible enough to be adjusted in the future based on market developments and future international standards.

| Liked reading? Share this story |

|

Subscribe to our daily newsletter ETtech Morning Dispatch for the latest insights from the world of technology and startups. |

| Subscribe |

Economic Survey 2023: India's EV market to hit 1 crore units in annual sales by 2030

The Economic Survey 2023 has said that the automotive industry is expected to play a

critical role in transition towards green energy, pointing out that the domestic electric vehicles (EV) market is likely to grow at a compounded annual growth rate (CAGR) of 49% between 2022 and 2030, hitting 1 crore units in annual sales by 2030.

It specifically highlighted the production-linked incentive (PLI) scheme for advanced chemistry cells, which is expected to lead to faster EV adoption. The scheme has a tenure from FY23 through FY27, and has an outlay of Rs 18,000 crore.

Also read: Digital deals, R&D spends aid IT sector clock 15.5% growth in FY22 Tweet of the day

| Liked reading? Share this story |

|

Digital public infra can add up to 100 bps to GDP growth rate: CEA Nageswaran

The untapped potential in India's digital public infrastructure (DPI) is huge and the country needs to continue to innovate to ensure the reach of the network is extended to more people, the Economic Survey has suggested.

India's

DPI can add around 60-100 basis points (BPS) to the country's potential GDP growth rate and there is a lot of justified optimism around it, said Chief Economic Advisor V Anantha Nageswaran while presenting the Economic Survey of 2023.

DPI has enhanced quality of life: The use of such DPI has enhanced the quality of life for citizens to ensure the reach of social sector schemes to intended beneficiaries, especially during the pandemic, Nageswaran said in his report.

Successful vaccination drives through the one-stop Co-WIN portal, DigiLocker, Goods and Services Tax (GST) Sahay are a few success stories among many.

The platforms will democratise digital payments, enable interoperability, and bring down transaction costs. This could potentially transform how businesses and consumers interact at present.

Quote, unquote: "There is lots of justified optimism about India's digital public infrastructure. The digital infrastructure can help the hitherto excluded sections get a fair shot at accessing national and international markets," he said.

The bouquet of digital public infrastructure products like e-RUPI, E-Way Bill, and TReDS for MSMEs have ensured real value for money to consumers while reducing the compliance burden for producers, the Economic Survey added.

Also read: Agritech startups raised Rs 6,600 crore in funding over last four years | Liked reading? Share this story |

|

Stripe may raise $3 billion; valuation slashed to $55-60 billion: report

Online payments major

Stripe has held talks to raise $3 billion from its existing set of investors, according to a report by technology news site The Information. The Silicon Valley-based company is looking to pick up funds in a round led by New York-based Thrive Capital.

The VC firm, founded by businessman Joshua Kushner, is expected to pour about $1 billion into Stripe, the New York Times reported on Monday.

Slashed valuation: According to the report, the latest fundraising is expected to value the payments startup between $55 billion and $60 billion, which is a significant drop from its last round valuation of $95 billion.

Biggest fundraiser: Since its inception in 2010, Stripe has raised close to $2 billion in funds from Sequoia Capital, Founders Fund, and General Catalyst. The report added that if the new funding round goes through, it will be bigger than any of its previous fundraises.

Breathing space: The funding comes in the backdrop of the company weighing options between a public listing and a private market capital raise. The potential $3 billion funding round is expected to give the payments firm some breathing space and ease off the pressure to go public, The Information said.

Today's ETtech Top 5 newsletter was curated by Siddharth Sharma in Bengaluru and Gaurab Dasgupta in Delhi. Graphics and illustrations by Rahul Awasthi.

hate it

hate it  meh

meh  love it

love it

Comments

Post a Comment